Monday, June 29, 2009

Europe to get 35% of Russian gas via South Stream by 2015

Europe to get 35% of Russian gas via South Stream by 2015

MOSCOW, June 26 (RIA Novosti) - The South Stream gas pipeline will account for 35% of Russian gas supplies to Europe by 2015, Gazprom CEO Alexei Miller said on Friday. "We have taken the decision to increase the pipeline's capacity to 63 billion cubic meters. This means it will account for 35% of all Russian gas supplies to Europe in 2015," Miller said at an annual meeting of Gazprom shareholders. South Stream is a rival to the Western-backed Nabucco pipeline, designed to bring gas from Central Asia and the Caspian to Europe bypassing Russia. The European Union, nervous about growing energy dependence on Russia, is backing the project despite the current economic crisis. Miller described Gazprom's pipeline as "balanced and economically efficient," and said the South Stream and Nord Stream projects were the company's "strategic investment" in improving European energy security. Intergovernmental agreements have been signed with Bulgaria, Serbia, Hungary and Greece to lay the surface pipeline. Similar agreements are currently being negotiated with Slovenia and Austria. Investment in the South Stream project has been estimated at 25 billion euros ($35 billion).

MOSCOW, June 26 (RIA Novosti) - The South Stream gas pipeline will account for 35% of Russian gas supplies to Europe by 2015, Gazprom CEO Alexei Miller said on Friday. "We have taken the decision to increase the pipeline's capacity to 63 billion cubic meters. This means it will account for 35% of all Russian gas supplies to Europe in 2015," Miller said at an annual meeting of Gazprom shareholders. South Stream is a rival to the Western-backed Nabucco pipeline, designed to bring gas from Central Asia and the Caspian to Europe bypassing Russia. The European Union, nervous about growing energy dependence on Russia, is backing the project despite the current economic crisis. Miller described Gazprom's pipeline as "balanced and economically efficient," and said the South Stream and Nord Stream projects were the company's "strategic investment" in improving European energy security. Intergovernmental agreements have been signed with Bulgaria, Serbia, Hungary and Greece to lay the surface pipeline. Similar agreements are currently being negotiated with Slovenia and Austria. Investment in the South Stream project has been estimated at 25 billion euros ($35 billion).

Gazprom eyeing British markets

Gazprom eyeing British markets

MOSCOW, June 29 (UPI) -- Gazprom announced major plans to expand into the British energy market over the course of the next few years, corporate officials told shareholders. Gazprom chief Alexei Miller told officials at the annual shareholder meeting the energy monopoly could ship more than 266 billion cubic feet of natural gas to British markets each year. "Gazprom plans to account for 10 percent of the British market by 2011," he said. Gazprom opened its first offices in England in 1999, while expanding its retail and wholesale market footprint in the rest of Europe. Miller told shareholders the liberalization of European gas markets created an opportunity to move into broader markets through the use of underground storage facilities, RIA Novosti reports. Gazprom appears to be losing ground in its Asian markets, meanwhile, as China inks a 30-year gas deal with Turkmenistan. The deal means Turkmenistan increases its gas sales to Beijing by 30 percent to 1.4 trillion cubic feet each year while work begins on a 4,000-mile pipeline between the two countries. "This agreement is very important for ensuring a stable, long-term and adequate supply of gas for this pipeline," said China's vice-premier, Li Keqiang.

MOSCOW, June 29 (UPI) -- Gazprom announced major plans to expand into the British energy market over the course of the next few years, corporate officials told shareholders. Gazprom chief Alexei Miller told officials at the annual shareholder meeting the energy monopoly could ship more than 266 billion cubic feet of natural gas to British markets each year. "Gazprom plans to account for 10 percent of the British market by 2011," he said. Gazprom opened its first offices in England in 1999, while expanding its retail and wholesale market footprint in the rest of Europe. Miller told shareholders the liberalization of European gas markets created an opportunity to move into broader markets through the use of underground storage facilities, RIA Novosti reports. Gazprom appears to be losing ground in its Asian markets, meanwhile, as China inks a 30-year gas deal with Turkmenistan. The deal means Turkmenistan increases its gas sales to Beijing by 30 percent to 1.4 trillion cubic feet each year while work begins on a 4,000-mile pipeline between the two countries. "This agreement is very important for ensuring a stable, long-term and adequate supply of gas for this pipeline," said China's vice-premier, Li Keqiang.

Russia seals Azeri gas deal

Russia seals Azeri gas deal

06-29-2009 - Upstream OnLine - Russian gas giant Gazprom signed a gas supply deal with Azerbaijan today, though the terms of the agreement remain unclear, according to reports. The news of the deal came as Gazprom chief executive Alexei Miller said the company would import a modest 500 million cubic metres of Azeri gas from 2010, a Reuters report said. The news agency quoted Miller as saying that import volumes would, however, increase. Miller also told reporters that Azerbaijan has promised to give Gazprom priority as buyer when gas from the second phase of the Shah Deniz development comes on stream. Russia wants to secure Azeri gas supplies to fill the planned South Stream gas pipeline to Europe. The European Union has also been courting the government in Baku as it bids to line up feedstock for the Nabucco pipeline, which circumvents Russia.

06-29-2009 - Upstream OnLine - Russian gas giant Gazprom signed a gas supply deal with Azerbaijan today, though the terms of the agreement remain unclear, according to reports. The news of the deal came as Gazprom chief executive Alexei Miller said the company would import a modest 500 million cubic metres of Azeri gas from 2010, a Reuters report said. The news agency quoted Miller as saying that import volumes would, however, increase. Miller also told reporters that Azerbaijan has promised to give Gazprom priority as buyer when gas from the second phase of the Shah Deniz development comes on stream. Russia wants to secure Azeri gas supplies to fill the planned South Stream gas pipeline to Europe. The European Union has also been courting the government in Baku as it bids to line up feedstock for the Nabucco pipeline, which circumvents Russia.

Friday, June 26, 2009

Gazprom: Deals near with Azerbaijan

Gazprom: Deals near with Azerbaijan

June 26, 2009 - Business Week-AP - Gazprom, the world's largest natural gas producer, said Friday it hoped to sign key deals in Azerbaijan next week, raising the possibility that Russia will secure Azeri gas to feed pipelines to Europe. "We enjoy good relations with Azerbaijan," chief executive Alexei Miller said at a shareholders' meeting at the company's Moscow headquarters. "And we hope that during next week's trip to Baku we will reach important agreements." State-run Gazprom has sought in recent years to corner the Central Asian gas supply, and reached preliminary agreement in March to buy Azeri gas from 2010. Russia requires more gas to feed two planned gas export pipelines -- North Stream and South Stream -- that would enable it to boost supplies substantially to Europe over the next decade. The European Union is backing a rival Europe-bound pipeline project called Nabucco that would hook up Central Asian or Middle Eastern gas with a pipeline in Turkey. The project has progressed slowly, however, because its investors have not yet secured supplies to fill it.

Gazprom Aims For 10% Of UK Gas Market By 2011 - CEO

Gazprom Aims For 10% Of UK Gas Market By 2011 - CEO

JUNE 26, 2009 - Dow Jones - MOSCOW. Russian gas firm OAO Gazprom (GAZP.RS) plans to control 10% of the U.K. natural gas market by 2011, the company's chief executive, Alexei Miller, said Friday. Volumes of Russian gas sold on the U.K. market has tripled in the last few years, Miller told an annual shareholder meeting. Gazprom currently supplies 7.5 billion cubic meters of gas a year to U.K. consumers. In 2006, Gazprom dropped its ambition to take control of U.K gas firm Centrica PLC (CNA.LN)after UK politicians voiced concerns about giving the state-controlled Russian firm a large influence over the country's energy supply.

JUNE 26, 2009 - Dow Jones - MOSCOW. Russian gas firm OAO Gazprom (GAZP.RS) plans to control 10% of the U.K. natural gas market by 2011, the company's chief executive, Alexei Miller, said Friday. Volumes of Russian gas sold on the U.K. market has tripled in the last few years, Miller told an annual shareholder meeting. Gazprom currently supplies 7.5 billion cubic meters of gas a year to U.K. consumers. In 2006, Gazprom dropped its ambition to take control of U.K gas firm Centrica PLC (CNA.LN)after UK politicians voiced concerns about giving the state-controlled Russian firm a large influence over the country's energy supply.

Thursday, June 25, 2009

Gazprom may cut its investprogram by 30 pct this year

Gazprom may cut its investprogram by 30 pct this year

MOSCOW, June 25, 2009 (Itar-Tass) - Gazprom intends to reconsider and to approve an adjusted budget of the holding in August-September this year. Andrei Kruglov, Deputy Chairman of the Board and head of the Gazprom financial and economic department, told a news conference here on Thursday, "This is normal practice for Gazprom to reconsider the parameters of the company’s budget on the strength of half-year results". Kruglov pointed out that the results of the first quarter -- during which a decline in gas prices, the complex situation concerning Ukraine, and a continuation of the economic downturn played a substantial role -- are no indicators that determine a trend for the entire year. Therefore, the holding will orient itself to the results of the second quarter and the first six-month period as a whole. "Taking into consideration the decline in demand for gas on the world markets, Gazprom intends to cut investments," Kruglov emphasized. He said, "The overall scope of investment programme adjustment may amount to about 30 percent downward". Gazprom's investment programme, which is calculated on the strength of the forecast for average annual oil price of $42 per barrel, amounts to 920,000 million roubles this year. Speakng of adjustment plans, Kruglov pointed out, "One of key tasks among the anti-crisis measures is to determine priorities more efficiently". "We do not plan seriously to cut down capital expenses on priority projects and on the construction of key processing and transportation facilities," he assured. Kruglov also stressed that Gazprom affords enough monetary resources and open credit lines to ensure a sufficient level of liquidity".

MOSCOW, June 25, 2009 (Itar-Tass) - Gazprom intends to reconsider and to approve an adjusted budget of the holding in August-September this year. Andrei Kruglov, Deputy Chairman of the Board and head of the Gazprom financial and economic department, told a news conference here on Thursday, "This is normal practice for Gazprom to reconsider the parameters of the company’s budget on the strength of half-year results". Kruglov pointed out that the results of the first quarter -- during which a decline in gas prices, the complex situation concerning Ukraine, and a continuation of the economic downturn played a substantial role -- are no indicators that determine a trend for the entire year. Therefore, the holding will orient itself to the results of the second quarter and the first six-month period as a whole. "Taking into consideration the decline in demand for gas on the world markets, Gazprom intends to cut investments," Kruglov emphasized. He said, "The overall scope of investment programme adjustment may amount to about 30 percent downward". Gazprom's investment programme, which is calculated on the strength of the forecast for average annual oil price of $42 per barrel, amounts to 920,000 million roubles this year. Speakng of adjustment plans, Kruglov pointed out, "One of key tasks among the anti-crisis measures is to determine priorities more efficiently". "We do not plan seriously to cut down capital expenses on priority projects and on the construction of key processing and transportation facilities," he assured. Kruglov also stressed that Gazprom affords enough monetary resources and open credit lines to ensure a sufficient level of liquidity".

Gazprom Sees No Reason for 'Panic'

Gazprom Sees No Reason for 'Panic'

25 June 2009 - The Moscow Times by Anatoly Medetsky - Gazprom deputy chief Alexander Medvedev defended the company's sales policy on Wednesday, responding to reports that the gas producer has lost part of the lucrative European market. Customers were buying less gas only temporarily because they built up large reserves last summer in anticipation of higher prices at the start of this year, said Medvedev, the company's exports chief. Gazprom at the time posted better sales growth than one of its rival's, Norway's StatoilHydro, he said. "Actually, this can be characterized as a shift in demand for an earlier period," Medvedev said at a news conference. "That's why we, in Gazprom, don't see any reason for panic and pessimism." Data from the International Energy Agency showed last week that Gazprom's market share in Europe and Turkey plunged to 16 percent in the first quarter of this year, compared with 30 percent last summer. European customers preferred buying cheaper LNG in spot trading from Gazprom's competitors because contracts with the Russian company fix prices for pipeline gas to those of oil six to nine months ago, when it hovered at record-high levels. Russia's reputation as a gas exporter also took a hit in January, when a dispute over supplies and transit in Ukraine led to widespread shortages throughout much of Europe. Gazprom exported to Europe just 74 percent of what it planned to in the first half of this year, or 59.5 billion cubic meters, Medvedev said. Demand in Europe has been rising again since April as Gazprom's prices decline, Medvedev reiterated. There was no commercial sense in offering discounts to increase the volume of sales in the first quarter, Medvedev said. Deputy Energy Minister Sergei Kudryashov criticized Gazprom's loss of sales volumes to Europe at an energy conference in Moscow on Tuesday, according to a copy of his speech on the ministry's web site. The ministry retracted the comments later that evening, saying the wrong document was posted because of a technical error. It was replaced with a different, shorter address that did not contain the criticism. Gazprom anticipates an average price of $280 per thousand cubic meters for its gas this year, which would be on par with the 2007 level, Medvedev said. He described the price as "quite satisfactory" and insisted that it would allow the company to develop. Gazprom is planning to export 142.1 billion cubic meters of gas to Europe and Turkey this year, a decrease from last year's 158.8 bcm. The gas will come from its own production, independent producers and Central Asian imports, he said.

25 June 2009 - The Moscow Times by Anatoly Medetsky - Gazprom deputy chief Alexander Medvedev defended the company's sales policy on Wednesday, responding to reports that the gas producer has lost part of the lucrative European market. Customers were buying less gas only temporarily because they built up large reserves last summer in anticipation of higher prices at the start of this year, said Medvedev, the company's exports chief. Gazprom at the time posted better sales growth than one of its rival's, Norway's StatoilHydro, he said. "Actually, this can be characterized as a shift in demand for an earlier period," Medvedev said at a news conference. "That's why we, in Gazprom, don't see any reason for panic and pessimism." Data from the International Energy Agency showed last week that Gazprom's market share in Europe and Turkey plunged to 16 percent in the first quarter of this year, compared with 30 percent last summer. European customers preferred buying cheaper LNG in spot trading from Gazprom's competitors because contracts with the Russian company fix prices for pipeline gas to those of oil six to nine months ago, when it hovered at record-high levels. Russia's reputation as a gas exporter also took a hit in January, when a dispute over supplies and transit in Ukraine led to widespread shortages throughout much of Europe. Gazprom exported to Europe just 74 percent of what it planned to in the first half of this year, or 59.5 billion cubic meters, Medvedev said. Demand in Europe has been rising again since April as Gazprom's prices decline, Medvedev reiterated. There was no commercial sense in offering discounts to increase the volume of sales in the first quarter, Medvedev said. Deputy Energy Minister Sergei Kudryashov criticized Gazprom's loss of sales volumes to Europe at an energy conference in Moscow on Tuesday, according to a copy of his speech on the ministry's web site. The ministry retracted the comments later that evening, saying the wrong document was posted because of a technical error. It was replaced with a different, shorter address that did not contain the criticism. Gazprom anticipates an average price of $280 per thousand cubic meters for its gas this year, which would be on par with the 2007 level, Medvedev said. He described the price as "quite satisfactory" and insisted that it would allow the company to develop. Gazprom is planning to export 142.1 billion cubic meters of gas to Europe and Turkey this year, a decrease from last year's 158.8 bcm. The gas will come from its own production, independent producers and Central Asian imports, he said.

Gazprom Waits for Obama

Gazprom Waits for Obama

Wednesday, June 24, 2009

Gazprom defends export policies as sales plunge

Gazprom defends export policies as sales plunge

June 24, 2009 (Reuters by Simon Shuster) - MOSCOW, Russia's Gazprom (GAZP.MM) expects its sales to Europe to drop 40 percent this year, its export chief said on Wednesday, but sees European demand picking up from April as the average price in 2009 falls by a third. At a news briefing, Alexander Medvedev rebuffed accusations that a rigid pricing policy was to blame for the plummetting sales, and insisted that Gazprom would not offer cheaper gas to stimulate demand. Exports to Europe from the world's largest gas company will stand at only 142 billion cubic metres this year, down from 158.8 last year, with export revenues falling to $40 billion from $65 billion, Medvedev said. "When there is a global storm there is no safe haven anywhere," he said. Medvedev added that a sharp drop in exports in the first half of 2009 was not the result of the financial crisis, but of gas prices on the spot market that were half those in Gazprom's long-term contacts. "Our consumers, being rational in their approach, have opted for the less expensive choice," he said. But the average price of gas is falling, and will soon help bring consumers back around to Russian imports, Medvedev said. He forecast that the average cost of Russian gas will be more than $280 per thousand cubic metres on export markets in 2009, down from $400 in 2008 but at the upper range of previous guidance. NO NEED FOR PANIC: Some analysts agreed that discounts could be counterproductive for Gazprom. "If they now, as prices are falling, break their pricing policy by giving discounts, their customers in Europe would also ask for discounts when the prices start rising," said Maria Radina, an oil and gas analyst at UBS in Moscow. "That could result in a complete spot situation, which would mean a loss of predictability in future sales and volumes." European consumers, which buy a quarter of their gas from Gazprom, have also been buying more alternative fuels and cutting imports as they wait for gas prices to catch up with the sharply lower oil prices. Medvedev said Algeria and Nigeria suffered from the same problem in the fourth quarter of 2008 and the first quarter of 2009 and only Norway had increased supplies. "But we don't see any reason to panic or for pessimism," said Medvedev, adding he believed Gazprom will boost its European market share in the future. "Norway has no special flexibility. The structure of their price formula is such that the spot segment is prevailing," he said, countering remarks by an energy ministry official this week that Gazprom should have been more flexible in its pricing. "The advantage of our contracts is in price predictability," he said. "It doesn't make any sense to halve prices to see offtake picking up by, let's say, 3 percent". "And starting from April we are seeing gas imports are beginning to exceed our expectations," he added.

June 24, 2009 (Reuters by Simon Shuster) - MOSCOW, Russia's Gazprom (GAZP.MM) expects its sales to Europe to drop 40 percent this year, its export chief said on Wednesday, but sees European demand picking up from April as the average price in 2009 falls by a third. At a news briefing, Alexander Medvedev rebuffed accusations that a rigid pricing policy was to blame for the plummetting sales, and insisted that Gazprom would not offer cheaper gas to stimulate demand. Exports to Europe from the world's largest gas company will stand at only 142 billion cubic metres this year, down from 158.8 last year, with export revenues falling to $40 billion from $65 billion, Medvedev said. "When there is a global storm there is no safe haven anywhere," he said. Medvedev added that a sharp drop in exports in the first half of 2009 was not the result of the financial crisis, but of gas prices on the spot market that were half those in Gazprom's long-term contacts. "Our consumers, being rational in their approach, have opted for the less expensive choice," he said. But the average price of gas is falling, and will soon help bring consumers back around to Russian imports, Medvedev said. He forecast that the average cost of Russian gas will be more than $280 per thousand cubic metres on export markets in 2009, down from $400 in 2008 but at the upper range of previous guidance. NO NEED FOR PANIC: Some analysts agreed that discounts could be counterproductive for Gazprom. "If they now, as prices are falling, break their pricing policy by giving discounts, their customers in Europe would also ask for discounts when the prices start rising," said Maria Radina, an oil and gas analyst at UBS in Moscow. "That could result in a complete spot situation, which would mean a loss of predictability in future sales and volumes." European consumers, which buy a quarter of their gas from Gazprom, have also been buying more alternative fuels and cutting imports as they wait for gas prices to catch up with the sharply lower oil prices. Medvedev said Algeria and Nigeria suffered from the same problem in the fourth quarter of 2008 and the first quarter of 2009 and only Norway had increased supplies. "But we don't see any reason to panic or for pessimism," said Medvedev, adding he believed Gazprom will boost its European market share in the future. "Norway has no special flexibility. The structure of their price formula is such that the spot segment is prevailing," he said, countering remarks by an energy ministry official this week that Gazprom should have been more flexible in its pricing. "The advantage of our contracts is in price predictability," he said. "It doesn't make any sense to halve prices to see offtake picking up by, let's say, 3 percent". "And starting from April we are seeing gas imports are beginning to exceed our expectations," he added.

Gazprom Sees 2009 Gas Export At 142.1B Cubic Meters

Gazprom Sees 2009 Gas Export At 142.1B Cubic Meters

Turkmenistan: Gazprom wants Ashgabat to give deep discount on natural

gas

Turkmenistan: Gazprom wants Ashgabat to give deep discount on natural

gas

June 23, 2009 - Eurasianet - Russian media outlets are reporting that the Kremlin-controlled conglomerate Gazprom is pushing for an almost 50 percent cut in the price it pays to the Turkmen government for natural gas. A Gazprom delegation headed by Alexander Medvedev, the company’s deputy board chairman, was in Ashgabat on June 23. Medvedev was expected to seek a downward revision in the gas pricing structure. Gazprom paid $300 per thousand cubic meters of gas (tcm) during the January-March period of this year, according to Kommersant. Medvedev will reportedly offer to pay $220/tcm for Turkmen gas during the third quarter of 2009, and $160/tcm for the fourth quarter of this year.

June 23, 2009 - Eurasianet - Russian media outlets are reporting that the Kremlin-controlled conglomerate Gazprom is pushing for an almost 50 percent cut in the price it pays to the Turkmen government for natural gas. A Gazprom delegation headed by Alexander Medvedev, the company’s deputy board chairman, was in Ashgabat on June 23. Medvedev was expected to seek a downward revision in the gas pricing structure. Gazprom paid $300 per thousand cubic meters of gas (tcm) during the January-March period of this year, according to Kommersant. Medvedev will reportedly offer to pay $220/tcm for Turkmen gas during the third quarter of 2009, and $160/tcm for the fourth quarter of this year.

Russia's Gazprom to sign oil deal with Nigeria

Russia's Gazprom to sign oil deal with Nigeria

June 23, 2009 - (Reuters by Randy Fabi) - ABUJA, Gazprom (GAZP.MM) is expected to sign a joint venture agreement with Nigeria's state-run oil firm NNPC as part of the Russian president's visit to Africa's biggest oil producer on Wednesday, a senior Kremlin source said. Details of the deal were not available, but Gazprom in February said it was close to sealing a $2.5 billion oil and gas exploration deal that would create a 50/50 joint venture with the Nigerian National Petroleum Corp. [ID:nLP386561] Russian President Dmitry Medvedev travels to Nigeria's capital Abuja on Wednesday to meet with President Umaru Yar'Adua and promote Moscow's economic interests in Africa's most populous country. "A number of intergovernmental agreements are expected to be signed after the talks in Abuja, including a document on the founding of a joint venture between Gazprom and Nigeria's NNPC," said a senior Kremlin official, who asked not to be named. An NNPC official also confirmed the planned signing, but declined to provide details. A senior Gazprom source told Reuters in February that 90 percent of the $2.5 billion investment would be in developing Nigeria's domestic gas production, processing and transportation. Nigeria has the world's seventh-largest proven gas reserves, but has been unable to develop its gas industry to anywhere near full potential because of a lack of funds and regulation. Some industry experts in Europe see Russia's deals with African OPEC members like Nigeria as an attempt to increase control on Europe's natural gas supplies. Gazprom already provides a quarter of Europe's gas.

June 23, 2009 - (Reuters by Randy Fabi) - ABUJA, Gazprom (GAZP.MM) is expected to sign a joint venture agreement with Nigeria's state-run oil firm NNPC as part of the Russian president's visit to Africa's biggest oil producer on Wednesday, a senior Kremlin source said. Details of the deal were not available, but Gazprom in February said it was close to sealing a $2.5 billion oil and gas exploration deal that would create a 50/50 joint venture with the Nigerian National Petroleum Corp. [ID:nLP386561] Russian President Dmitry Medvedev travels to Nigeria's capital Abuja on Wednesday to meet with President Umaru Yar'Adua and promote Moscow's economic interests in Africa's most populous country. "A number of intergovernmental agreements are expected to be signed after the talks in Abuja, including a document on the founding of a joint venture between Gazprom and Nigeria's NNPC," said a senior Kremlin official, who asked not to be named. An NNPC official also confirmed the planned signing, but declined to provide details. A senior Gazprom source told Reuters in February that 90 percent of the $2.5 billion investment would be in developing Nigeria's domestic gas production, processing and transportation. Nigeria has the world's seventh-largest proven gas reserves, but has been unable to develop its gas industry to anywhere near full potential because of a lack of funds and regulation. Some industry experts in Europe see Russia's deals with African OPEC members like Nigeria as an attempt to increase control on Europe's natural gas supplies. Gazprom already provides a quarter of Europe's gas.

Tuesday, June 23, 2009

Gazprom is king of the hill in Russian region

Gazprom is king of the hill in Russian region

06–23–2009 Associated Press — MOSCOW. Coming soon to the stunning snowcapped peaks of southern Siberia — probably the world's highest billboard. Leaders in the remote Russian region of Altai want to name one of the region's tallest mountains in honor of Gazprom, the state-run natural gas monopoly and corporate behemoth. It was unclear whether the mountain currently has a name. The Altai government's Web site says an official expedition is expected to climb the 11,200-foot (3,410-meter) peak this summer to erect a giant Gazprom logo on top. Local lawmakers hope the logo will be seen for miles around. For western consumers, Gazprom is more associated with acrimonious disputes that turned off gas supplies to Europe and symbolizes Russia's blunt-edged energy clout. But for many Russians the corporation that was once one of the world's largest is emblematic of Russia's resurgence. Gazprom did not respond to request for comment.

06–23–2009 Associated Press — MOSCOW. Coming soon to the stunning snowcapped peaks of southern Siberia — probably the world's highest billboard. Leaders in the remote Russian region of Altai want to name one of the region's tallest mountains in honor of Gazprom, the state-run natural gas monopoly and corporate behemoth. It was unclear whether the mountain currently has a name. The Altai government's Web site says an official expedition is expected to climb the 11,200-foot (3,410-meter) peak this summer to erect a giant Gazprom logo on top. Local lawmakers hope the logo will be seen for miles around. For western consumers, Gazprom is more associated with acrimonious disputes that turned off gas supplies to Europe and symbolizes Russia's blunt-edged energy clout. But for many Russians the corporation that was once one of the world's largest is emblematic of Russia's resurgence. Gazprom did not respond to request for comment.

Monday, June 22, 2009

Gazprom Neft on $1bn cash hunt

Gazprom Neft on $1bn cash hunt

06-22-2009 - Upstream OnLine - Gazprom Neft, the oil arm of Russian gas giant Gazprom, may issue up to $1 billion in bonds and raise a club loan as it weighs up buying a number of assets in Russia, Kazakhstan and Slovenia, as news emerged that the company had backed down over its choice of chief executive at Sibir Energy. Gazprom Neft boss Alexander Dyukov told Reuters the company was considering buying mid-sized Russian producer Russneft, Kazakhstan's Pavlodar refinery and Slovenia's top fuel retailer Petrol. Gazprom Neft has already spent over $1 billion in the past month to amass a 34 % stake in London-listed Sibir in a move widely perceived as a Kremlin strategy to use the financial crisis to further strengthen its grip over key industries at home and expand its influence abroad. "Petrol could be interesting. We bought (Serbia's) NIS and this is 4 million tonnes of annual oil refining with an option to increase it to between 5 million and 6 million. And we are interested in increasing our (retail) network," Dyukov said. He said talks were still going on about Russneft - the first public revelation that Gazprom Neft could become the ultimate owner of the indebted player, whose shares are now held as collateral with Russia's top lender, state-run Sberbank . "Russneft is a question of price," said Dyukov. He also said the company had no plans to increase its stake in Sibir from 34% after buying out virtually all of the company's free float. He said Gazprom Neft was holding talks with the remaining shareholders, who include several Russian businessmen and the government of Moscow, to manage the asset. Today, Sibir re-appointed Stuard Detmer its chief executive at Gazprom Neft's request, reversing last week's management reshuffle, which saw Detmer replaced by Gazprom Neft's top legal expert Igor Tsibelman. Tsibelman will now become the first deputy chief executive to Detmer, "to ensure the seamless transition of the management of the company", Sibir said in a statement. "Igor Tsibelman's appointment was a (Sibir) board decision ... It was premature to do it. There is a (standard) procedure of handover and it should not take place suddenly," said Dyukov, adding that Sibir was likely to get a new chief executive -- Tsibelman or somebody else - within two to three weeks.

06-22-2009 - Upstream OnLine - Gazprom Neft, the oil arm of Russian gas giant Gazprom, may issue up to $1 billion in bonds and raise a club loan as it weighs up buying a number of assets in Russia, Kazakhstan and Slovenia, as news emerged that the company had backed down over its choice of chief executive at Sibir Energy. Gazprom Neft boss Alexander Dyukov told Reuters the company was considering buying mid-sized Russian producer Russneft, Kazakhstan's Pavlodar refinery and Slovenia's top fuel retailer Petrol. Gazprom Neft has already spent over $1 billion in the past month to amass a 34 % stake in London-listed Sibir in a move widely perceived as a Kremlin strategy to use the financial crisis to further strengthen its grip over key industries at home and expand its influence abroad. "Petrol could be interesting. We bought (Serbia's) NIS and this is 4 million tonnes of annual oil refining with an option to increase it to between 5 million and 6 million. And we are interested in increasing our (retail) network," Dyukov said. He said talks were still going on about Russneft - the first public revelation that Gazprom Neft could become the ultimate owner of the indebted player, whose shares are now held as collateral with Russia's top lender, state-run Sberbank . "Russneft is a question of price," said Dyukov. He also said the company had no plans to increase its stake in Sibir from 34% after buying out virtually all of the company's free float. He said Gazprom Neft was holding talks with the remaining shareholders, who include several Russian businessmen and the government of Moscow, to manage the asset. Today, Sibir re-appointed Stuard Detmer its chief executive at Gazprom Neft's request, reversing last week's management reshuffle, which saw Detmer replaced by Gazprom Neft's top legal expert Igor Tsibelman. Tsibelman will now become the first deputy chief executive to Detmer, "to ensure the seamless transition of the management of the company", Sibir said in a statement. "Igor Tsibelman's appointment was a (Sibir) board decision ... It was premature to do it. There is a (standard) procedure of handover and it should not take place suddenly," said Dyukov, adding that Sibir was likely to get a new chief executive -- Tsibelman or somebody else - within two to three weeks.

Gazprom’s Miller May Earn $5.3 Million for 2008, Vedomosti Says

Gazprom’s Miller May Earn $5.3 Million for 2008, Vedomosti Says

Gazprom clinches Kyrgyz market

Gazprom clinches Kyrgyz market

BISHKEK, Kyrgyzstan, June 19, 2009 (UPI) -- In an attempt to revive its aging natural gas industry, Kyrgyzstan is turning to Russia's state-owned natural gas giant Gazprom. Kyrgyzstan's Belyi Parus newspaper reported Friday that according to the Kyrgyz government's latest official reports, Gazprom has agreed to purchase 75 percent of shares plus one share of the state gas enterprise Kyrgyzgaz. In addition, Gazprom has agreed to close out all the old debts of Kyrgyz gas transport enterprises, estimated at $13 million. The deal culminates discussions begun between Gazprom and Kyrgyzgaz in 2003, when an agreement was initialed between the two companies establishing cooperation in the oil and gas sector for 25 years. For years the Kyrgyz government has attempted to procure foreign investment in its energy sector but has been largely unsuccessful. Among potential investors Russia has shown the greatest interest. In February Kyrgyz President Kurmanbek Bakiyev during a visit to Moscow managed to procure a $2 billion loan, which included money to help Kyrgyzstan build the 1,900-MW Karambata 1 hydroelectric project.

Tuesday, June 16, 2009

Gazprom warns on delays to key field

Gazprom warns on delays to key field

June 16 2009 - Financial Times by Catherine Belton - Russia’s Gazprom, the world’s largest gas producer, warned on Tuesday it could delay the development of a flagship project crucial for future European supplies by one year in order to help cut spending by 15 per cent. Gazprom’s deputy chief executive, Alexander Ananenkov, said that the company could postpone the launch of the giant Bovanenkovo field until the third quarter of 2012 because of expectations that global gas demand would remain depressed for the next three years. He said: “We see that there won’t be demand for that gas. So why invest money in what is not in demand?” If approved by the board, the postponement of the Bovanenkovo field, part of the Yamal peninsula, would be the first big Gazprom project to be hit by the crisis. The Russian state-controlled monopoly, which supplies 25 percent of Europe’s gas needs, has been hit hard by sharply falling demand in Europe, Ukraine and at home, while the heavily-indebted energy giant’s finances are being squeezed by falling prices for gas, which follow the oil price with a lag of about six months. Gazprom’s output fell 34 per cent year on year to its lowest level in more than a decade in May due to the drop in worldwide demand. Mr Ananenkov said the company had revised its output forecasts down to 507bn cubic meters in 2010, 510bcm in 2011 and 523bcm in 2012 – sharply down on the 550bcm Gazprom produced in 2008. But in a sign of the uncertainty still surrounding demand, Mr Ananenkov said Gazprom’s output this year could be anywhere between 450bcm and 510bcm. Valery Nesterov, energy analyst at Troika Dialog, the Moscow investment bank, said he expected other Gazprom projects to face cuts as a result of the crisis. “It would not be surprising if there were delays to other big projects,” he said, including to the vast Arctic Shtokman field, which Gazprom is to develop together with France’s Total and Norway’s StatoilHydro. An investment decision is due on the field next year. Mr Nesterov said a decision to delay Bovanenkovo would show Gazprom was being sensible in cutting spending as it faces a sharp drop in cash flow. “This will help stabilize the financial situation of the company,” he said. Analysts at Troika had predicted Gazprom would need to cut its overall investment programme of Rbs920bn ($29bn) by 25 per cent this year. Mr Ananenkov did not say whether other projects would face cuts. The gas giant is yet to announce cuts to its investment programme. But Mr Ananenkov said the delay to Bovanenkovo would help Gazprom cuts its capital expenditure programme for this year to Rbs500bn from the planned Rbs637bn. Gazprom has been hit especially hard in the first quarter of the year European consumers sharply reduced gas purchases because of prices still being at an all-time high. Gas prices run at a six-month lag to oil prices. Mr Ananenkov said demand had recovered in April, May and June: after falling as low as 260-280m cubic metres per day, daily demand in Europe was now back as high as 430m cubic metres per day.

June 16 2009 - Financial Times by Catherine Belton - Russia’s Gazprom, the world’s largest gas producer, warned on Tuesday it could delay the development of a flagship project crucial for future European supplies by one year in order to help cut spending by 15 per cent. Gazprom’s deputy chief executive, Alexander Ananenkov, said that the company could postpone the launch of the giant Bovanenkovo field until the third quarter of 2012 because of expectations that global gas demand would remain depressed for the next three years. He said: “We see that there won’t be demand for that gas. So why invest money in what is not in demand?” If approved by the board, the postponement of the Bovanenkovo field, part of the Yamal peninsula, would be the first big Gazprom project to be hit by the crisis. The Russian state-controlled monopoly, which supplies 25 percent of Europe’s gas needs, has been hit hard by sharply falling demand in Europe, Ukraine and at home, while the heavily-indebted energy giant’s finances are being squeezed by falling prices for gas, which follow the oil price with a lag of about six months. Gazprom’s output fell 34 per cent year on year to its lowest level in more than a decade in May due to the drop in worldwide demand. Mr Ananenkov said the company had revised its output forecasts down to 507bn cubic meters in 2010, 510bcm in 2011 and 523bcm in 2012 – sharply down on the 550bcm Gazprom produced in 2008. But in a sign of the uncertainty still surrounding demand, Mr Ananenkov said Gazprom’s output this year could be anywhere between 450bcm and 510bcm. Valery Nesterov, energy analyst at Troika Dialog, the Moscow investment bank, said he expected other Gazprom projects to face cuts as a result of the crisis. “It would not be surprising if there were delays to other big projects,” he said, including to the vast Arctic Shtokman field, which Gazprom is to develop together with France’s Total and Norway’s StatoilHydro. An investment decision is due on the field next year. Mr Nesterov said a decision to delay Bovanenkovo would show Gazprom was being sensible in cutting spending as it faces a sharp drop in cash flow. “This will help stabilize the financial situation of the company,” he said. Analysts at Troika had predicted Gazprom would need to cut its overall investment programme of Rbs920bn ($29bn) by 25 per cent this year. Mr Ananenkov did not say whether other projects would face cuts. The gas giant is yet to announce cuts to its investment programme. But Mr Ananenkov said the delay to Bovanenkovo would help Gazprom cuts its capital expenditure programme for this year to Rbs500bn from the planned Rbs637bn. Gazprom has been hit especially hard in the first quarter of the year European consumers sharply reduced gas purchases because of prices still being at an all-time high. Gas prices run at a six-month lag to oil prices. Mr Ananenkov said demand had recovered in April, May and June: after falling as low as 260-280m cubic metres per day, daily demand in Europe was now back as high as 430m cubic metres per day.

Gazprom: 2010 Gas Output 507 BCM; Delays Major Field Launch

Gazprom: 2010 Gas Output 507 BCM; Delays Major Field Launch

Kyrgyzstan: Parliament approves sale of Kyrgyzgaz to Gazprom

Kyrgyzstan: Parliament approves sale of Kyrgyzgaz to Gazprom

6/15/09 - Eurasia.net - The Kyrgyz parliament has approved a draft agreement on the sale of KyrgyzGaz to Russia's Gazprom. Gazprom hopes to take a 75-percent-plus-one share stake in the debt-ridden company. "In doing so, they are required to reliably supply gas to all consumers as well as to modernize and reconstruct the existing equipment, make major repairs of pipelines and all the debts that are now on the balance sheet belong to the Russian investors," Tursun Turdumambetov, the chairman of the State Property Committee, said on June 15. Renovation and upkeep of Kyrgyzstan's aging gas infrastructure is expected to cost about $400 million, media reports added. Earlier in June, Gazprom announced it was prepared to invest $300 million in exploration work in Kyrgyzstan over the next three years. Kyrgyzstan is estimated to have gas reserves of 6 billion cubic meters.

6/15/09 - Eurasia.net - The Kyrgyz parliament has approved a draft agreement on the sale of KyrgyzGaz to Russia's Gazprom. Gazprom hopes to take a 75-percent-plus-one share stake in the debt-ridden company. "In doing so, they are required to reliably supply gas to all consumers as well as to modernize and reconstruct the existing equipment, make major repairs of pipelines and all the debts that are now on the balance sheet belong to the Russian investors," Tursun Turdumambetov, the chairman of the State Property Committee, said on June 15. Renovation and upkeep of Kyrgyzstan's aging gas infrastructure is expected to cost about $400 million, media reports added. Earlier in June, Gazprom announced it was prepared to invest $300 million in exploration work in Kyrgyzstan over the next three years. Kyrgyzstan is estimated to have gas reserves of 6 billion cubic meters.

Turkmenistan: Gazprom boss holds meeting with Berdymukhamedov

Turkmenistan: Gazprom boss holds meeting with Berdymukhamedov

6/15/09 - Eurasia.net - Gazprom boss Alexei Miller has held face-to-face talks with President Gurbanguly Berdymukhamedov in Ashgabat. Initial results appeared inconclusive. During their meeting "the parties emphasized the long-term nature of the Russian-Turkmen partnership in the gas sector. The discussion centered on the plans for strategic cooperation and the issues of interaction between Gazprom and Turkmenneftegaz over 2009 to 2010," a press statement from Gazprom said on June 15. Turkmenistan and Gazprom have a 25-year cooperation agreement signed in 2003, which sews up Gazprom's control of Turkmenistan's gas exports. [For background see the Eurasia Insight archive]. Relations between the Kremlin-controlled energy giant and Central Asian state have been far from easy since demand for gas on the European market dried up earlier this year and a gas pipeline explosion on April 9 halted Turkmen gas exports into Gazprom's supply network.

6/15/09 - Eurasia.net - Gazprom boss Alexei Miller has held face-to-face talks with President Gurbanguly Berdymukhamedov in Ashgabat. Initial results appeared inconclusive. During their meeting "the parties emphasized the long-term nature of the Russian-Turkmen partnership in the gas sector. The discussion centered on the plans for strategic cooperation and the issues of interaction between Gazprom and Turkmenneftegaz over 2009 to 2010," a press statement from Gazprom said on June 15. Turkmenistan and Gazprom have a 25-year cooperation agreement signed in 2003, which sews up Gazprom's control of Turkmenistan's gas exports. [For background see the Eurasia Insight archive]. Relations between the Kremlin-controlled energy giant and Central Asian state have been far from easy since demand for gas on the European market dried up earlier this year and a gas pipeline explosion on April 9 halted Turkmen gas exports into Gazprom's supply network.

Gazprom losing to StatoilHydro in European market

Gazprom losing to StatoilHydro in European market

2009-06-15 - Barents Observer - Gazprom’s exports to the EU in the first quarter of the year dropped 35,3 percent. Meanwhile, StatoilHydro boosts its export and is now almost as big as the Russian producer in the European market. Gazprom and StatoilHydro might be allies in the High North and partners in the Shtokman gas project. However, in the European gas market, the two companies are tough competitors. As Gazprom’s exports to the EU market are plummeting, StatoilHydro’s exports are booming. While Gazprom in the first quarter of the year exported 35,3 percent less to the EU countries compared with the same period in 2008, StatoilHydro’s export is picking pace and is now only about five percent less than the Russian, newspaper Kommersant reports. Only a year ago, StatoilHydro’s export the EU countries was only about half of Gazprom’s. According to the company annual report, StatoilHydro in 2008 exported a total of 76,8 billion cubic meters of gas to European importers, which accounted for about 15 percent of continent demands. The bigger Norwegian exports come as the EU is cutting overall gas consumption. Union consumption declined 5,4 percent in the first quarter of the year. Meanwhile, imports decreased a total of 13,7 percent. The export dynamics are reflected also in production figures. While Gazprom in the first quarter of 2009 produced eight percent less than in the same period in 2008, StatoilHydro increased production with 21 percent, Kommersant writes.

2009-06-15 - Barents Observer - Gazprom’s exports to the EU in the first quarter of the year dropped 35,3 percent. Meanwhile, StatoilHydro boosts its export and is now almost as big as the Russian producer in the European market. Gazprom and StatoilHydro might be allies in the High North and partners in the Shtokman gas project. However, in the European gas market, the two companies are tough competitors. As Gazprom’s exports to the EU market are plummeting, StatoilHydro’s exports are booming. While Gazprom in the first quarter of the year exported 35,3 percent less to the EU countries compared with the same period in 2008, StatoilHydro’s export is picking pace and is now only about five percent less than the Russian, newspaper Kommersant reports. Only a year ago, StatoilHydro’s export the EU countries was only about half of Gazprom’s. According to the company annual report, StatoilHydro in 2008 exported a total of 76,8 billion cubic meters of gas to European importers, which accounted for about 15 percent of continent demands. The bigger Norwegian exports come as the EU is cutting overall gas consumption. Union consumption declined 5,4 percent in the first quarter of the year. Meanwhile, imports decreased a total of 13,7 percent. The export dynamics are reflected also in production figures. While Gazprom in the first quarter of 2009 produced eight percent less than in the same period in 2008, StatoilHydro increased production with 21 percent, Kommersant writes.

Monday, June 15, 2009

New Era For Gazprom, As Gas Giant's Fortunes Plummet

New Era For Gazprom, As Gas Giant's Fortunes Plummet

June 10, 2009 RFE-RL by Bruce Pannier - It's been a tough year for Gazprom, Russia's state-controlled gas giant. Just a year ago, Russia's state-owned gas giant Gazprom was the third-most valuable company in the world, worth some $350 billion. Now, it has shrunk by two-thirds to about $120 billion, declining to the world's 40th-largest company, according to "The Moscow Times" on May 27. And the company appears set to fall another notch or two, thanks to a ruling by Russian antimonopoly authorities on June 2 that Gazprom must share its export pipelines with independent gas producers. Federico Bordonaro, a senior analyst at the Italian analytical group equilibri.net, says some of Gazprom's problems were easy to foresee. He notes that Gazprom "benefitted enormously" from the steep rise in oil and natural-gas prices in recent years, and then suffered a "huge blow" when prices fell in the middle of 2008. Bordonaro adds that Gazprom's investment strategy "wasn't probably the best suited for them," because instead of "investing in technology and innovation, maintenance, and instead of pursuing the policy of transference" during the boom years, "they did other things" such as buying other companies. "They increased their size; and they proceeded to [do] a series of deals that were not always very transparent. They lost credibility, they threatened crisis, and they actually got involved in the Russo-Ukrainian crisis of the beginning of this year," Bordonaro says. Bordonaro points out that among the consequences of these investment policies are debts of $4 billion that continue to grow. Gazprom's pipeline network, a large part of it in Russia, is also aging and in need of upgrading. As "The "Moscow Times" noted on May 27, "No other company has so many explosions on major pipelines."

June 10, 2009 RFE-RL by Bruce Pannier - It's been a tough year for Gazprom, Russia's state-controlled gas giant. Just a year ago, Russia's state-owned gas giant Gazprom was the third-most valuable company in the world, worth some $350 billion. Now, it has shrunk by two-thirds to about $120 billion, declining to the world's 40th-largest company, according to "The Moscow Times" on May 27. And the company appears set to fall another notch or two, thanks to a ruling by Russian antimonopoly authorities on June 2 that Gazprom must share its export pipelines with independent gas producers. Federico Bordonaro, a senior analyst at the Italian analytical group equilibri.net, says some of Gazprom's problems were easy to foresee. He notes that Gazprom "benefitted enormously" from the steep rise in oil and natural-gas prices in recent years, and then suffered a "huge blow" when prices fell in the middle of 2008. Bordonaro adds that Gazprom's investment strategy "wasn't probably the best suited for them," because instead of "investing in technology and innovation, maintenance, and instead of pursuing the policy of transference" during the boom years, "they did other things" such as buying other companies. "They increased their size; and they proceeded to [do] a series of deals that were not always very transparent. They lost credibility, they threatened crisis, and they actually got involved in the Russo-Ukrainian crisis of the beginning of this year," Bordonaro says. Bordonaro points out that among the consequences of these investment policies are debts of $4 billion that continue to grow. Gazprom's pipeline network, a large part of it in Russia, is also aging and in need of upgrading. As "The "Moscow Times" noted on May 27, "No other company has so many explosions on major pipelines."Not So 'European': Gazprom also appears to have suffered from deals it worked out last year with Kazakhstan, Turkmenistan, and Uzbekistan. Last year, as the price of gas was rising, Gazprom agreed to pay the three Central Asian states "European" prices for their gas. The deal was initially looked upon as a success, because it headed off moves by European Union countries to reach agreement on filling a rival pipeline project that would bring the gas by a route that avoided Russian territory. But the "European" prices that were at one time approaching $400 per 1,000 cubic meters of gas, have since fallen to below $300 and are expected to be closer to $200 before year's end. This means that exports to Europe are bringing in less income at a time when Russian pipelines are filled with gas imported from Central Asia under at times questionable terms. Turkmenistan, for one, has read its end of the bargain as meaning that Gazprom must pay European prices that were in place at the time the agreement for Turkmen imports was reached. Professor Jonathan Stern, director of gas research at the Oxford Institute for Energy Studies, says that Gazprom now "has to turn around, and it has turned around, and to Central Asian countries and particularly to Turkmenistan and said, 'Look, we don't need your gas and anyway we can't pay these prices that we said we were going to pay.' And the Central Asians, obviously, are not at all happy about this."

Gazprom's Fall From Grace?: Stern says the antitrust ruling that Gazprom must share its export pipelines has compounded the gas giant's problems, and he notes that the independent producers have strong allies within the government. He describes it as a "long-running story" and one of the few areas where Prime Minister Vladimir Putin and Deputy Prime Minister Igor Sechin are "really at odds" with Gazprom's management. "They believe that Gazprom is not allowing a large enough role for independent producers. Gazprom is arguing that it's allowing as big a role as it possibly can," Stern says. "But Putin and Sechin believe that, in fact, independent production is being restricted -- as indeed, it certainly is because with this new situation we have with hugely falling Russian gas demand -- and in fact gas demand everywhere -- [and] Gazprom has far too much gas and is trying to cut back all sources of supply." The situation has led some observers to wonder whether Gazprom has officially fallen from grace, and is now headed for a shake-up in management. Stern says it is too early to tell, but notes that "this is one of the very few areas where the Putin-Medvedev administration -- particularly Putin even when he was president -- was not happy with the conduct of the Gazprom management."

Gazprom blasts market speculation

Gazprom blasts market speculation

PORTO CERVO, Italy, June 11,2009 (UPI) -- The mechanisms defining the price of oil need reassessment to produce a favorable climate for investors, officials with Russian energy Gazprom said in Italy. Alexei Miller, the chief executive for Gazprom, spoke at the 12th Annual General Assembly of the European Business Congress in Porto Cervo, Italy, on the economic climate in the energy sector. "The imbalance in favor of 'financial' transactions on the oil market has led to a situation where the oil price mostly reflects the trends on the equity market rather than on the hydrocarbons market," he said. In the prelude to the global economic recession, Gazprom had predicted oil prices would reach $250 per barrel. Miller backed off those estimates, but said it was realistic to assume oil would settle at around $100 or $150 in the next few years. "There are objective reasons to predict the oil market has pinpointed $100 per barrel as benchmark price in 2010," he said. He stressed the need to "radically revise" the pricing mechanisms in the oil sector, saying it was falsely linked to financial conditions, not the physical oil markets, faulting speculators for the recent surge in oil prices. Russia and other international energy players, therefore, will face economic difficulties in creating an attractive investment environment to boost production and a favorable consumer climate, Miller said

PORTO CERVO, Italy, June 11,2009 (UPI) -- The mechanisms defining the price of oil need reassessment to produce a favorable climate for investors, officials with Russian energy Gazprom said in Italy. Alexei Miller, the chief executive for Gazprom, spoke at the 12th Annual General Assembly of the European Business Congress in Porto Cervo, Italy, on the economic climate in the energy sector. "The imbalance in favor of 'financial' transactions on the oil market has led to a situation where the oil price mostly reflects the trends on the equity market rather than on the hydrocarbons market," he said. In the prelude to the global economic recession, Gazprom had predicted oil prices would reach $250 per barrel. Miller backed off those estimates, but said it was realistic to assume oil would settle at around $100 or $150 in the next few years. "There are objective reasons to predict the oil market has pinpointed $100 per barrel as benchmark price in 2010," he said. He stressed the need to "radically revise" the pricing mechanisms in the oil sector, saying it was falsely linked to financial conditions, not the physical oil markets, faulting speculators for the recent surge in oil prices. Russia and other international energy players, therefore, will face economic difficulties in creating an attractive investment environment to boost production and a favorable consumer climate, Miller said

Wednesday, June 10, 2009

German military asks for change to Nord Stream route - paper

German military asks for change to Nord Stream route - paper

Gazprom Neft eyes $500m-$1bn Eurobond

Gazprom Neft eyes $500m-$1bn Eurobond

Gazprom targets 10% of US gas market

Gazprom targets 10% of US gas market

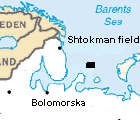

06-10-2009 - Upstream OnLine - Russian gas export monopoly Gazprom plans to raise deliveries to the US and eventually supply up to 10% of the the country's gas needs, a senior company official said on today. "The volumes we currently supply account for 0.5% of gas consumed (in the US). But with the gas from Shtokman and Yamal, our share will grow to 5% to 10%," Gazprom executive Alexander Medvedev said. "We plan to supply 17% of the Shtokman gas to North America," he said. Gazprom views Yamal and Shtokman as key sources of future output as production falls at mature deposits in West Siberia. Shtokman, in the Barents Sea is scheduled to start producing gas for export by pipeline by 2013 and as liquefied natural gas in 2014. Gazprom owns 51%, while France's Total holds 25% and Norway's StatoilHydro owns 24%.

06-10-2009 - Upstream OnLine - Russian gas export monopoly Gazprom plans to raise deliveries to the US and eventually supply up to 10% of the the country's gas needs, a senior company official said on today. "The volumes we currently supply account for 0.5% of gas consumed (in the US). But with the gas from Shtokman and Yamal, our share will grow to 5% to 10%," Gazprom executive Alexander Medvedev said. "We plan to supply 17% of the Shtokman gas to North America," he said. Gazprom views Yamal and Shtokman as key sources of future output as production falls at mature deposits in West Siberia. Shtokman, in the Barents Sea is scheduled to start producing gas for export by pipeline by 2013 and as liquefied natural gas in 2014. Gazprom owns 51%, while France's Total holds 25% and Norway's StatoilHydro owns 24%.

Gas price rise good for Gazprom plans

Gas price rise good for Gazprom plans

MOSCOW, June 9, 2009 (UPI) -- An increase in gas prices will finance liquefied natural gas projects for Gazprom and possible expansion into North America, company officials said. Alexander Medvedev told the Russian-language Ekho Moskvy radio station that he predicted third- and fourth-quarter price increases, suggesting those trends positioned Gazprom for exports into U.S. markets. In February, Russia opened its first LNG plant on Sakhalin Island to supply mostly Asian markets with natural gas from the nearby facility. Medvedev said that gas eventually could reach American markets through Mexico, the Interfax news agency reports. "We already have the opportunity to ship Sakhalin gas to the U.S. market via the Baja regasification terminal in Mexico, we have reserved pipeline capacity and we're prepared to work on that market and will do so," he said. On the regional transit network, Medvedev insisted the Russian Nord Stream pipeline to Germany and the South Stream pipeline to southeastern Europe were meant to diversify the energy sector, not secure Russian dominance. A January price and contract row between Kiev and Moscow prompted Gazprom to cut gas supplies to Ukraine for weeks. That put renewed focus on the need to diversify the regional oil and gas transit network as 80 percent of Russian gas for Europe travels through Soviet-era pipelines in Ukraine.

MOSCOW, June 9, 2009 (UPI) -- An increase in gas prices will finance liquefied natural gas projects for Gazprom and possible expansion into North America, company officials said. Alexander Medvedev told the Russian-language Ekho Moskvy radio station that he predicted third- and fourth-quarter price increases, suggesting those trends positioned Gazprom for exports into U.S. markets. In February, Russia opened its first LNG plant on Sakhalin Island to supply mostly Asian markets with natural gas from the nearby facility. Medvedev said that gas eventually could reach American markets through Mexico, the Interfax news agency reports. "We already have the opportunity to ship Sakhalin gas to the U.S. market via the Baja regasification terminal in Mexico, we have reserved pipeline capacity and we're prepared to work on that market and will do so," he said. On the regional transit network, Medvedev insisted the Russian Nord Stream pipeline to Germany and the South Stream pipeline to southeastern Europe were meant to diversify the energy sector, not secure Russian dominance. A January price and contract row between Kiev and Moscow prompted Gazprom to cut gas supplies to Ukraine for weeks. That put renewed focus on the need to diversify the regional oil and gas transit network as 80 percent of Russian gas for Europe travels through Soviet-era pipelines in Ukraine.

Gazprom Aims to Supply Up to 10% of U.S. Gas Market

Gazprom Aims to Supply Up to 10% of U.S. Gas Market

June 9, 2009 (Bloomberg by Stephen Bierman) - OAO Gazprom, the Russian exporter of a quarter of Europe’s natural gas, is seeking as much as 10 percent of the U.S. gas market by 2020 after two Arctic liquefied natural gas projects start producing. “The volume which we have right now is just 0.5 percent of natural gas consumption of the United States but with gas out of Shtokman and, maybe Yamal LNG, our share in the U.S. and Canada market would go up to between 5 and 10 percent,” Deputy Chief Executive Officer Alexander Medvedev told reporters today. Gazprom is aiming to develop the projects after opening Russia’s first LNG plant off the Pacific Ocean coast with Royal Dutch Shell Plc and Japanese partners in February. The state-run company, with StatoilHydro ASA and Total SA, intend to take an investment decision in the first half of 2010 on Shtokman, which has enough gas to meet world demand for more than a year. “We targeted that approximately 17 percent of the Shtokman volumes would reach North America,” Medvedev, speaking in English, said before a roundtable discussion with Royal representatives. The state run gas exporter estimates global LNG demand to grow at an average annual rate of 6 percent to 8 percent for the next few years, Medvedev said.

June 9, 2009 (Bloomberg by Stephen Bierman) - OAO Gazprom, the Russian exporter of a quarter of Europe’s natural gas, is seeking as much as 10 percent of the U.S. gas market by 2020 after two Arctic liquefied natural gas projects start producing. “The volume which we have right now is just 0.5 percent of natural gas consumption of the United States but with gas out of Shtokman and, maybe Yamal LNG, our share in the U.S. and Canada market would go up to between 5 and 10 percent,” Deputy Chief Executive Officer Alexander Medvedev told reporters today. Gazprom is aiming to develop the projects after opening Russia’s first LNG plant off the Pacific Ocean coast with Royal Dutch Shell Plc and Japanese partners in February. The state-run company, with StatoilHydro ASA and Total SA, intend to take an investment decision in the first half of 2010 on Shtokman, which has enough gas to meet world demand for more than a year. “We targeted that approximately 17 percent of the Shtokman volumes would reach North America,” Medvedev, speaking in English, said before a roundtable discussion with Royal representatives. The state run gas exporter estimates global LNG demand to grow at an average annual rate of 6 percent to 8 percent for the next few years, Medvedev said.Feasibility Study: Gazprom will also cooperate with OAO Novatek, Russia’s largest non-state gas producer, on a feasibility study for an LNG facility to export gas from deposits on the Yamal peninsula, Medvedev said. Gazprom owns just under 20 percent of Novatek. Gazprom has already received several proposals on the project as well as an “arrangement with Shell” on LNG development in Russia, Medvedev said. “In the next two to four years there are some major challenges for the LNG business,” said Daniel Yergin, chairman of the Cambridge Energy Research Associates. “We see for the short term what we call a gas bubble having developed.” Yergin attributed the “bubble” to the surge in natural gas supply, including new LNG, and the technological advances that have made unconventional gas profitable in the U.S. as well as the global economic crisis. “There’s one factor that makes natural gas, of all the hydrocarbons, the most forward looking fuel, and that is as you see the climate change agenda around the world getting stronger natural gas is going to be in a preferable position,” Yergin said. The Yamal peninsula may hold 22 trillion cubic meters of gas, enough to supply world demand for more than a decade, and may produce as much as 115 billion cubic meters a year by 2015, according to Gazprom’s Web site. “Even in the current depressed pricing situation with LNG in different parts of the world and relatively low prices in Henry Hub, we still do not see any danger to the feasibility of Shtokman,” Medvedev said, adding that a lack of investment may lead to a supply shortage as early as 2014.

Gazprom aims to supply 5-10 pct of US gas needs

Gazprom aims to supply 5-10 pct of US gas needs

MOSCOW, June 9, 2009 (Reuters) - Russian gas export monopoly Gazprom (GAZP.MM) plans to raise deliveries to the United States and eventually supply up to 10 percent of the world's biggest economy's gas needs, a senior company official said on Tuesday. "The volumes we currently supply account for 0.5 percent of gas consumed (in the United States). But with the gas from Shtokman and Yamal, our share will grow to 5-10 percent," Gazprom Deputy Chief Executive Alexander Medvedev said. "We plan to supply 17 percent of the Shtokman gas to North America," he said. Gazprom, the world's largest gas producer and supplier of a quarter of Europe's gas, views Yamal and Shtokman as key sources of future output as production falls at mature deposits in West Siberia. Shtokman, in the Barents sea, is one of the largest gas fields in the world and is scheduled to start producing gas for export by pipeline by 2013 and as liquefied natural gas in 2014. Gazprom owns 51 percent of Shtokman Development AG, while France's Total holds 25 percent and StatoilHydro owns 24 percent.

MOSCOW, June 9, 2009 (Reuters) - Russian gas export monopoly Gazprom (GAZP.MM) plans to raise deliveries to the United States and eventually supply up to 10 percent of the world's biggest economy's gas needs, a senior company official said on Tuesday. "The volumes we currently supply account for 0.5 percent of gas consumed (in the United States). But with the gas from Shtokman and Yamal, our share will grow to 5-10 percent," Gazprom Deputy Chief Executive Alexander Medvedev said. "We plan to supply 17 percent of the Shtokman gas to North America," he said. Gazprom, the world's largest gas producer and supplier of a quarter of Europe's gas, views Yamal and Shtokman as key sources of future output as production falls at mature deposits in West Siberia. Shtokman, in the Barents sea, is one of the largest gas fields in the world and is scheduled to start producing gas for export by pipeline by 2013 and as liquefied natural gas in 2014. Gazprom owns 51 percent of Shtokman Development AG, while France's Total holds 25 percent and StatoilHydro owns 24 percent.

Gazprom in talks with Novatek on joint LNG project in Siberia

Gazprom in talks with Novatek on joint LNG project in Siberia

MOSCOW, June 9, 2009 (RIA Novosti) - Gazprom is holding talks with independent gas producer Novatek on its possible participation in a liquefied natural gas project in northwest Siberia, a Gazprom deputy CEO said on Tuesday. Alexander Medvedev said Gazprom will prepare a project feasibility study in early 2010 for LNG production on the Yamal Peninsula. The Yamal LNG plant will process the gas condensate resources from the Tambeiskoye field. Gazprom holds licenses to develop 26 Yamal fields (with total reserves exceeding 10 trillion cubic meters). It plans to annually produce 250 billion cubic meters of gas there. World markets could experience a shortage of liquefied natural gas by 2014 as some producers have delayed their LNG projects due to the global economic crisis, Medvedev said. Gazprom estimates that despite the current economic problems, global demand for LNG will grow at an annual rate of 6-8% to reach about 500-800 million metric tons by 2030, Medvedev said.

MOSCOW, June 9, 2009 (RIA Novosti) - Gazprom is holding talks with independent gas producer Novatek on its possible participation in a liquefied natural gas project in northwest Siberia, a Gazprom deputy CEO said on Tuesday. Alexander Medvedev said Gazprom will prepare a project feasibility study in early 2010 for LNG production on the Yamal Peninsula. The Yamal LNG plant will process the gas condensate resources from the Tambeiskoye field. Gazprom holds licenses to develop 26 Yamal fields (with total reserves exceeding 10 trillion cubic meters). It plans to annually produce 250 billion cubic meters of gas there. World markets could experience a shortage of liquefied natural gas by 2014 as some producers have delayed their LNG projects due to the global economic crisis, Medvedev said. Gazprom estimates that despite the current economic problems, global demand for LNG will grow at an annual rate of 6-8% to reach about 500-800 million metric tons by 2030, Medvedev said.

Gazprom May Borrow $10.5 Billion From Russian Banks

Gazprom May Borrow $10.5 Billion From Russian Banks

June 8, 2009 - (Bloomberg by Denis Maternovsky) - OAO Gazprom, Russia’s gas export monopoly, will seek approval from its shareholders to raise up to $10.5 billion in dollar, euro and ruble loans from state banks, it said in a statement on its Web site. Gazprom will ask a general shareholders’ meeting on June 26 to approve loans of as much as $6 billion from Vnesheconombank, Russia’s state development bank, $1.5 billion each from OAO Sberbank and Russian Agricultural Bank, $1 billion from VTB Group and $500 million from OAO Gazprombank, the company said. “Gazprom is simply either trying to insure itself against the possibility of the situation in the capital markets again taking a turn for the worse, or is looking for attractive alternative sources of refinancing,” said Sebastien de Prinsac, head of international sales at Trust Investment Bank in Moscow. Gazprom, which sold 500 million Swiss francs ($456 million) and $2.25 billion of bonds in April in Russia’s first foreign note offering in nine months, has $6.7 billion of debt maturing this year, according to data compiled by Bloomberg. Russian companies are struggling to refinance $146.7 billion of foreign debt in 2009 after the financial crisis cut access to new cash. The Moscow-based oil producer’s new loans may have maturities of as much as five years, according to the statement. The interest on the facilities shouldn’t exceed an annual 15 percent for the dollar or euro loans and 3 percentage points more than the central bank’s refinancing rate for the ruble debt, the company said. Gazprom has $52 billion of bonds and loans outstanding, Bloomberg data show. The company is rated Baa1 by Moody’s Investors Service, its third-lowest investment grade, and one level lower at BBB by Standard & Poor’s.

June 8, 2009 - (Bloomberg by Denis Maternovsky) - OAO Gazprom, Russia’s gas export monopoly, will seek approval from its shareholders to raise up to $10.5 billion in dollar, euro and ruble loans from state banks, it said in a statement on its Web site. Gazprom will ask a general shareholders’ meeting on June 26 to approve loans of as much as $6 billion from Vnesheconombank, Russia’s state development bank, $1.5 billion each from OAO Sberbank and Russian Agricultural Bank, $1 billion from VTB Group and $500 million from OAO Gazprombank, the company said. “Gazprom is simply either trying to insure itself against the possibility of the situation in the capital markets again taking a turn for the worse, or is looking for attractive alternative sources of refinancing,” said Sebastien de Prinsac, head of international sales at Trust Investment Bank in Moscow. Gazprom, which sold 500 million Swiss francs ($456 million) and $2.25 billion of bonds in April in Russia’s first foreign note offering in nine months, has $6.7 billion of debt maturing this year, according to data compiled by Bloomberg. Russian companies are struggling to refinance $146.7 billion of foreign debt in 2009 after the financial crisis cut access to new cash. The Moscow-based oil producer’s new loans may have maturities of as much as five years, according to the statement. The interest on the facilities shouldn’t exceed an annual 15 percent for the dollar or euro loans and 3 percentage points more than the central bank’s refinancing rate for the ruble debt, the company said. Gazprom has $52 billion of bonds and loans outstanding, Bloomberg data show. The company is rated Baa1 by Moody’s Investors Service, its third-lowest investment grade, and one level lower at BBB by Standard & Poor’s.

Gazprom and StatoilHydro pair up in north

Gazprom and StatoilHydro pair up in north

06-05-2009 - Upstream OnLine - The heads of Gazprom and StatoilHydro, Alexei Miller and Helge Lund, signed a three-year memorandum of understanding today to work together in exploring and developing northern regions of Russia and Norway. The agreement was signed in St. Petersburg today on the sidelines of the XIII International Economic Forum, and replaces the 2005 memorandum of understanding between Gazprom, Statoil and Hydro. “The document envisages that both companies jointly engage in geological exploration, development and production of hydrocarbon resources in northern regions,” said StatoilHydro in a statement. The agreement will not only see the two companies work together towards discovering and developing new fields, but also in the design of technologies for such activity. "The development of the biggest of the projects – the Shtokman field – will become a starting point for the development of Arctic hydrocarbon reserves, a catalyst for the design and adaptation of technologies, which will help our companies operate efficiently in harsh northern climatic conditions,” said Miller. Gazprom and StatoilHydro are partners in the Phase 1 of the Shtokman gas condensate field development.

06-05-2009 - Upstream OnLine - The heads of Gazprom and StatoilHydro, Alexei Miller and Helge Lund, signed a three-year memorandum of understanding today to work together in exploring and developing northern regions of Russia and Norway. The agreement was signed in St. Petersburg today on the sidelines of the XIII International Economic Forum, and replaces the 2005 memorandum of understanding between Gazprom, Statoil and Hydro. “The document envisages that both companies jointly engage in geological exploration, development and production of hydrocarbon resources in northern regions,” said StatoilHydro in a statement. The agreement will not only see the two companies work together towards discovering and developing new fields, but also in the design of technologies for such activity. "The development of the biggest of the projects – the Shtokman field – will become a starting point for the development of Arctic hydrocarbon reserves, a catalyst for the design and adaptation of technologies, which will help our companies operate efficiently in harsh northern climatic conditions,” said Miller. Gazprom and StatoilHydro are partners in the Phase 1 of the Shtokman gas condensate field development.

Friday, June 05, 2009

E.ON inks pact for Yuzhno Russkoye gas field

E.ON inks pact for Yuzhno Russkoye gas field